Content

Whilst every bank’s cellular financial application get work differently, the process basically comes after a comparable actions. Specific financial institutions will most likely not allow for mobile places to your particular items, such as foreign checks, thus make sure to comment their bank’s regulations beforehand. Mobile look at places provides turned financial administration by the enabling someone and you can businesses to deposit monitors easily rather than checking out a bank part.

Fruit Cocktail $1 deposit: What is Cellular Consider Put and just what membership qualify?

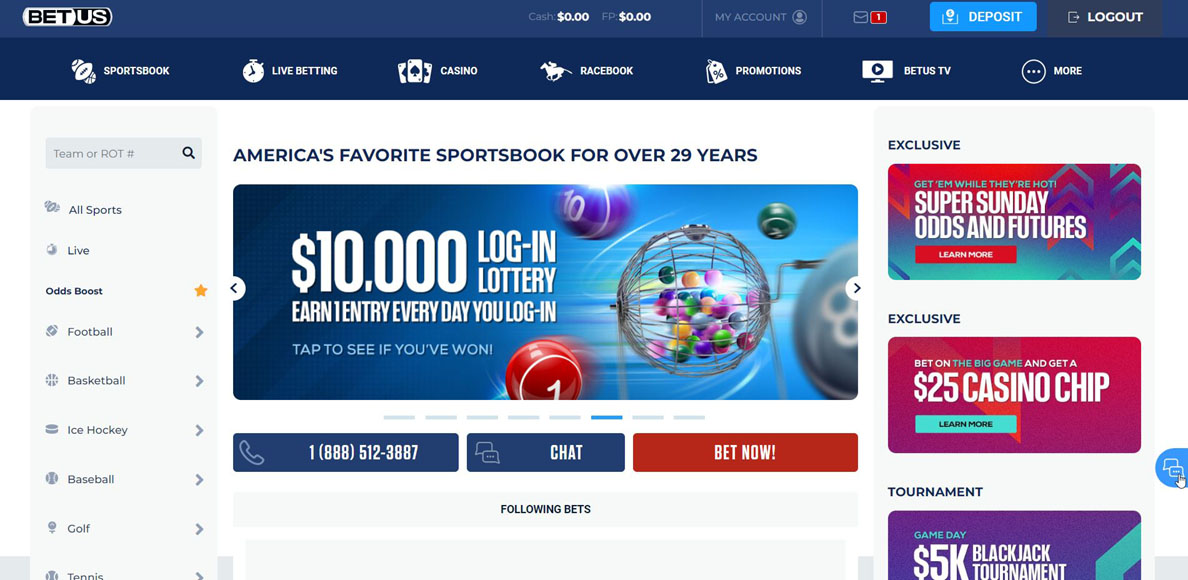

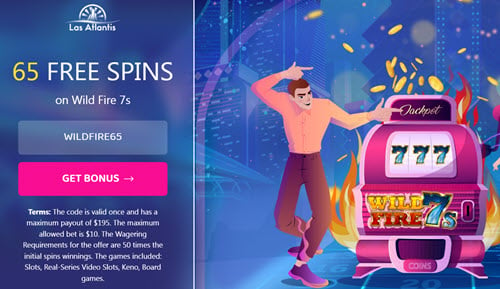

2nd, discover Spend By the Cellular means you want to have fun with (it Boku or Siru, for example). From the NewCasinos, we have been fully transparent in how i financing the website. We may earn a fee for those who just click certainly the partner links and then make in initial deposit from the no extra prices for your requirements. Our very own member partnerships don’t influence our ratings; i are nevertheless unbiased and sincere within suggestions and you may analysis very you can gamble responsibly and you can better-informed.

CNBC Discover demonstrates to you exactly how cellular view placing functions and some factors you ought to bear in mind.

Of many banks make it ranging from $1,100000 and $10,100 within the cellular dumps per day, however some can offer highest or down limitations. Look at your financial’s mobile deposit plan to understand your direct restriction. Cellular dumps often clear inside two business days, they lessen way too many vacation, and so they put a supplementary coating from protection thanks to encrypted technology. The brand new software spends encoding to safeguard your data and keep maintaining the deposit secure. Most banking institutions enable it to be cellular dumps for personal checks, organization monitors, cashier’s monitors, and you can regulators inspections.

Look at qualification

Come across ways to questions about how mobile view put functions, along with how to use they, what forms of checks you could put, and you will what to do having a check Fruit Cocktail $1 deposit once you deposit they. Less than, i number the brand new prepaid cards which have cellular places, purchased you start with an informed overall options. You could potentially shred otherwise disposable a after you deposit they during your mobile, but you would be to keep they for most days once. Sometimes it may look such as the consider tend to obvious great but if you have people things, it’s best to feel the brand-new file useful if you need are again. There’s no solitary cellular lender this is the perfect for all the situation. For example, some individuals might find Chime’s $200 fee-free overdraft extremely helpful while others usually like Friend Financial’s wider variance of financial characteristics.

This is actually the just like endorsing a newsprint make sure that you put at the a branch otherwise via an automatic teller machine. On the back of your take a look at the underside your trademark, you’ll must make the text “for cellular put simply” or specific version, according to your lender otherwise credit union’s standards. Without one, debt organization can get will not award the newest mobile view put and also the currency claimed’t end up being credited for your requirements. See Pursue.com/QuickDeposit or perhaps the Chase Cellular software to own eligible cell phones, limits, words, standards and you can information. Banks has mobile put restrictions in place to safeguard facing scam and ensure the security of the people’ fund. By the mode a limit to your cellular dumps, banking companies decrease the possibility of high deceptive purchases becoming processed through the cellular deposit feature.

Key Financial merely lets you deposit as much as $10,000 with your smartphone. Cellular financial is quite employed for some individuals, but you will find downsides you should think ahead of beginning an enthusiastic membership. Do you enjoy calling a neighborhood, Florida banker to go over your own personal economic means? Mobile consider deposit is regarded as secure because of actions such as security.

Army pictures can be used for representational aim merely; don’t indicate authorities approval. With regards to the kind of account you may have, debt business can charge a fee to help you put cheques electronically. Ask your financial institution when funds from a mobile cheque put might possibly be readily available. Money sales, bank drafts, authoritative cheques and you will traffic cheques may also be eligible for digital put. Be aware of qualification, keep symptoms and you can charges while they can differ out of in the-department banking. Stick to the instructions on your financial application so you can put their cheque.

Then advancements within the economic technology and you may increasing adoption cost are most likely to alter user experience and protection. MyBankTracker provides married having CardRatings for the exposure of charge card issues. MyBankTracker and you can CardRatings will get discover a fee out of card providers. Viewpoints, reviews, analyses & information is the blogger’s by yourself, and also have not become reviewed, supported otherwise passed by these agencies. MyBankTracker generates cash due to our very own relationships with your lovers and associates. We could possibly speak about otherwise tend to be reviews of its issues, sometimes, however it does not connect with the information, which can be completely in line with the look and functions in our article people.